PAN Card Verification

PAN verification online is a facility given to definite entities for the authentication of PAN. One can verify the PAN information on the part of somebody else thinking about they have all necessary details. The Income Tax Department has certified NSDL e Governance Infrastructure Limited to start an online PAN verification service to assist certified entities with authentication of PAN details. There are three modes by which one can validate their PAN details:

Types of PAN Verification Online

Screen based verification

- The users have to sign in initially to use this service

- Once they sign in, the users can provide up to a maximum of five PANs on the given screen and submit it

- The details of the PANs given will be provided as results

File based verification

- The users have to sign in first

- After that, upload a file including a maximum of 1000 PANs in the similar file structure stipulated by NSDL e-government

- Once the file is uploaded and submitted the website will give details of all the PANs offered within 24 hours of the submission

- The system will communicate a message of refusal if the uploaded file format is wrong

Software (API) based verification

This online facility will let the user to make a verification of PAN by going through a verification website via a software application.

Who can Verify PAN (Permanent Account Number)?

Below are list of individuals & groups who can verify PAN

- Non banking financial organizations

- Banks

- Insurance organization and repository

- Government deductors or companies that are needed to file TDS/TCS return

- Mutual funds

- Credit card organizations

- Educational institutes recognized by authoritarian bodies

- Stock exchanges or commodity exchanges, clearing companies

- Depositories

- Government organizations

- Income tax projects

- RBI

- Department of Commercial taxes

- Products and services tax network

PAN Card Verification Registration Online

The candidate who wants to register for Online PAN verification with NSDL e-Gov can do so by providing a few documents. The candidate should give a signed copy of the terms or conditions on the letterhead of the body along with a verification letter and a demand draft for the charges.

Details needed to register for Online PAN Verification

Organizational details needed to register for Online PAN Number Verification

- Name of the unit

- TAN or PAN of the unit

- Category of the unit

- Other personal information

- Contact info.

Payment details needed to register for Online PAN Card Verification

- Payment amount

- Method of payment

- Number of instrument

Digital signature certificate information needed to register for PAN Verification

- Certifying authority’s name

- Category of the Digital Signature Certificate

- Serial Number of Digital Signature Certificate

Tracking Registration Status

An organization who has tried to register for online PAN verification can track its registration status by using the given acknowledgement number. If the registration is done successfully, a text message bearing the same will be shown on the screen in conjunction with the User ID. A message showing the refusal will be displayed if it was refused or rejected.

Approval of Registration

The Income Tax Department has to approve the registration of a unit for Online PAN verification. Once the candidate registers, NSDL e-gov sends the registration request to the Income Tax Department saying that the candidate has filled up the form correctly and given the right documents and made a successful payment. The candidate will be given an eight digit User Id on successful verification. The registration cost will be reimbursed to the applicant in case the Income Tax Department refuses the request for registration.

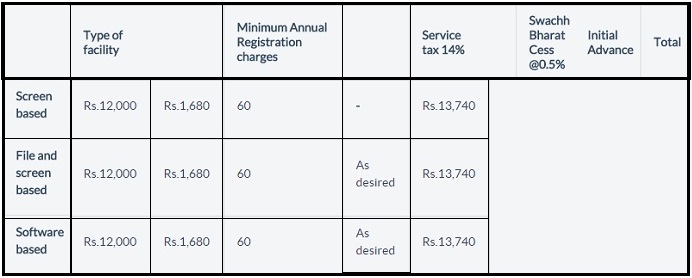

Online PAN Verification Facility Charges