If you have already applied for PAN card and hanging around to Know Your PAN Details, then here is a step-by-step guide to know your PAN Card status online. PAN card is an essential document as it is used for big financial transactions. Every Indian citizen, who makes more than 2.50 lakh Rs. in a year, is able to pay income tax as per Indian government. Finding out PAN Card details online is very simple. It involves some procedure by which you can authenticate your PAN Card Details Online.

Know Your PAN

When you have lost your PAN or did not remember your PAN card number or left your PAN card at home, you can simply Know PAN Card number just by filling up some details on Official Income Tax e-filing Website. In addition, with the help of PAN number, you can submit an application for duplicate PAN card in case if you have lost your PAN card. You can Know Your PAN by Date of Birth (DoB) and Name Online.

Income Tax Know your Pan

Pan Card is the most important document needed while filing income tax related work like income tax filling. Know your pan income tax filing process is very necessary.

Most of the people do not know how to check their PAN number without PAN card. So, those people have to go through provided details carefully. So, for well-beinging of applicants, we are giving some simple steps. Thus, the applicants of PAN card or PAN card holders have to go through the below steps to know their PAN details with PAN No. Online:

Process to Know Your PAN by Name and Date of Birth (DoB)

- Go to the Income Tax e-filing Site or Click here to visit

- Then click to “Know Your PAN”

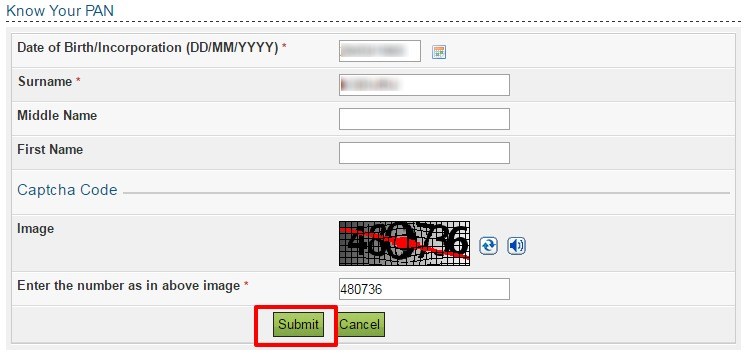

- After that, one form will open on your system as shown below

- Fill in your Date of Birth in a given format (DD/MM/YYYY).[Here DD represent Date, MM=Month & YYYY=Birth Year]

- After that, fill in your Surname (compulsory *), Middle Name as well as First Name in the form.

- Then, fill in captcha code for human identification.

- Then, press the submit Button, and get your PAN details.

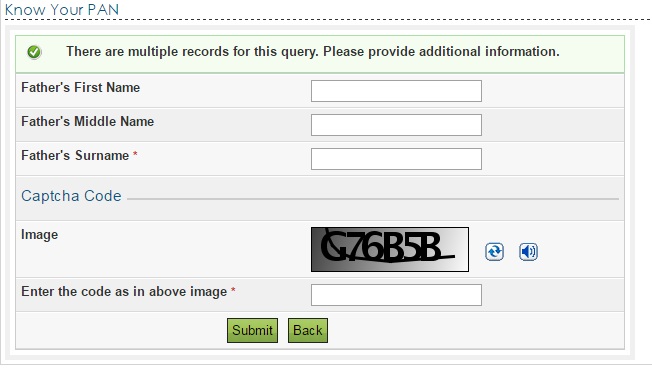

- If there are various records found for this inquiry, then please give additional details.

- Then, fill in your Father’s First Name, Middle Name and Surname (Compulsory) and fill in captcha details and click on submit button.

- After that, a new page will open in which you can verify your PAN information.

Fill all the details cautiously. - In case of any mistake, you can refresh the link and give all the information again.

Know Your PAN Detials form Income Tax e-filing Site Online

Need to know other details of PAN Card as Area code, AO Type, Range Code, Email ID, Status etc then you have to register at Income Tax Department Offical Site , although thess process is somewhat lenghty and takes some times to complete. We have proveded step by step procedure below, just follow these process:

- First Visit Official Income Tax e-filing (i.e., https://incometaxindiaefiling.gov.in/)

- On Right hand site, you will find “New To e-Filing?: Click on “Register Yourself“.

- Now Registration form will be open where you need to insert the required details as Individual/HUF and other.

- Fill the Form and submit the details.

- After submitting the details, an activation link to your provided email Id will be sent, click on that activation link to activate your account. You have successfully registered.

- Now you can login to site

- On Menu, click on “Profile Settings”

- You are now on “My Profile” where you have PAN Details, Address and Contact Details Tab.

- Click on “PAN Details” to know other PAN Card Details like

- Name of Assesses

- Date of Birth

- Gender

- Status

- Address of Assesses

Also you will find Jurisdiction Details as:

- Area Code

- AO Type

- AO Number

- Building Name

- Email ID

The people who have applied for PAN can go through their PAN card details by following the above methods. Thus, the applicants can get complete information on this page. In this post, we have provided updated details. So, go through carefully and know your PAN card information by name and DOB. You cannot get PAN card details with address.

PAN or Permanent Account Number is a 10 digit unique identification number; however it is a card of plastic, but a significant document as well as Identity proof. PAN card is started by Income Tax Department of India for collecting income tax, particularly for highly earned citizen.

PAN Cards can verify the taxpayers in our country. These days, with PAN card no details are compulsory for opening bank accounts, assets of sale, professional fee, driving license and passport. On top of that, PAN card is a significant identity proof for every citizen. So, PAN card is very essential for everyone. If anybody wants a new landline phone connection, mobile phone connection, depositing above 50,000/- as cash, and high-value transactions, PAN card is obligatory. Thus, the usage of PAN is growing regularly; the Central Government has started a new online service known as know your PAN for recently applied and current PAN Holders.