Aadhar Card is an individualized identity program that involves a person’s demographic and biometric details, making it the safest validation system for an individual’s identity and address, and hence the government has decided to make Aadhar card mandatory to be linked with other documents to support evidential validation regarding identity and address It negates the possibility of any kind of fraud and ensures that the Aadhaar benefits and services are availed by the appropriate and eligible citizen.

According to instructions from government, all three services from Employee’s Provident Fund Organization (EPFO) that includes Life Insurance, Provident Fund and Monthly Pension after service completion, requires Aadhar card as a platform for offering its services to the eligible beneficiaries. The Provident fund department officials’demand that all the employees who are availing the benefits of EPFO schemes are necessitated to immediately link their bank accounts to Aadhar card. This situation depicts that according to the decision of government, all the beneficiaries of such schemes need to link their bank accounts with their unique identification number.

The decision taken by the government has somewhat created a sense of worry among the EPFO officials. Now the benefits of EPFO are provided to the eligible beneficiaries directly in their bank accounts. The EPFO is providing 85% of the beneficiaries the payment through National Electronic Funds Transfer Program or NEFT.

Documents required to upload KYC information in UAN Portal

- A copy of self-attested PAN card

- A copy of the cancelled check/cheque leaf of your bank account (All information of bank shall be provided that are the account number, IFSC code, and beneficiary name)

- A copy of self-attested Aadhar card

Procedure to upload Aadhar for EPF Account

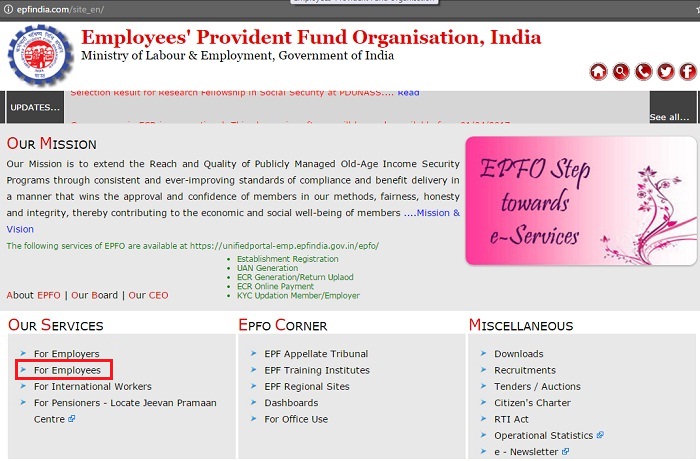

- Visit the EPF (Enployess’ Provident Fund Organisation, India) Official site at www.epfindia.com

- On the website, Click on “For Employees“.

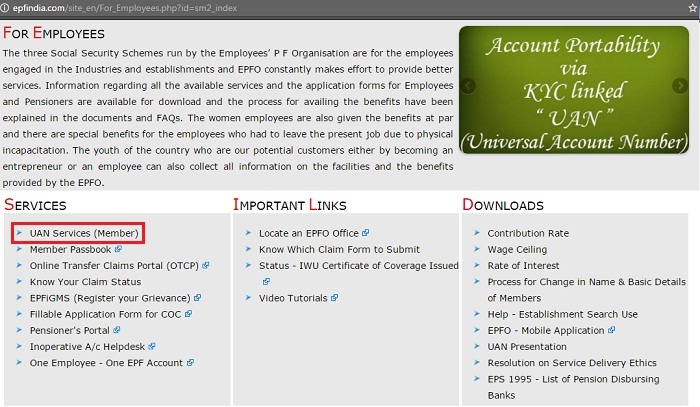

- After clicking, you have to click on “UAN Services (Member)” under Services section

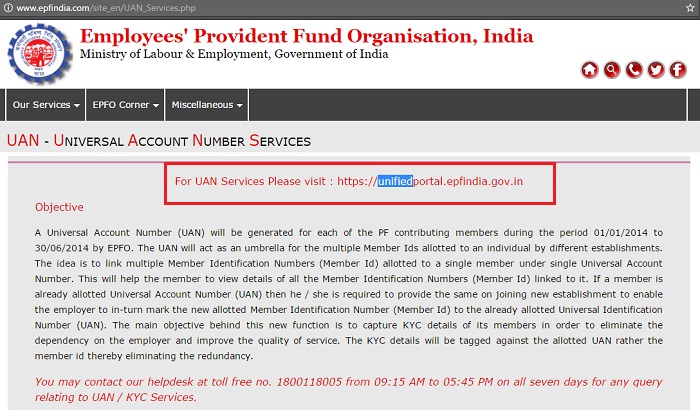

- Get details about Universal Account Number Services (UAN) and Visit to UAN Member Portal.

- Now you will need to login with your UAN Number and Password.

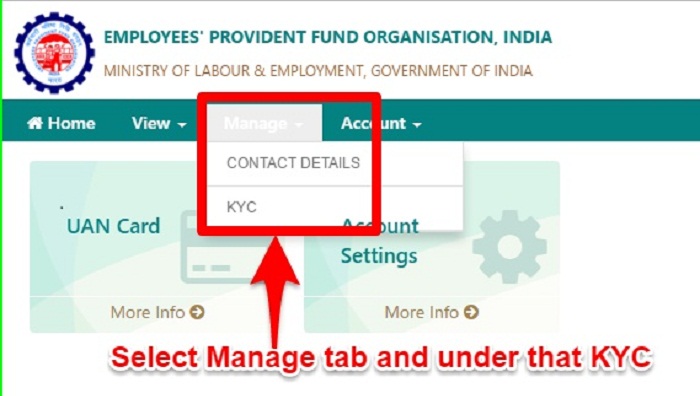

- Go to “Update KYC Information” under “Manage” Tab.

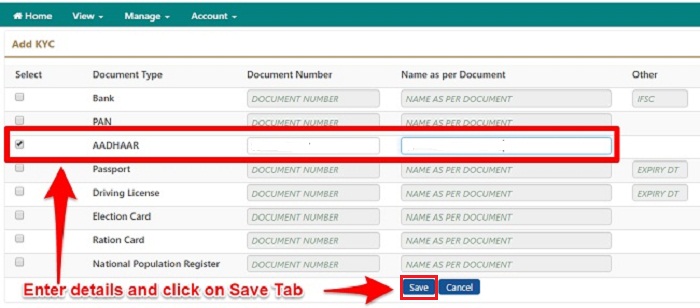

- When you have entered your KYC information on the webpage, you will be required to enter your PF number, in the current member ID box. Then select the KYC, the soft copies of your Aadhar card, PAN card and bank account number need to be self-attested and uploaded compulsorily.

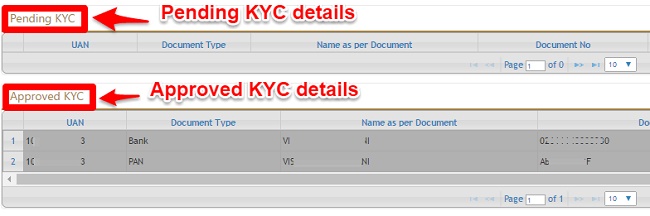

- When you have uploaded the documents, your details would be processed for approval, you may check the status after 15 days.

- Given below is how you would see an approval from the employer.

You must keep in mind that before linking your EPF account and UAN account to your Aadhar card, it is necessary to activate both accounts, and all the employees of public sector and private sector, must link their EPFO account and UAN account with their Aadhar card before 31st March.

I am getting again and again this error(Aadhaar authentication failed. AADHAAR number, Name, DOB or Gender mismatch with registered data.)

Thanks for sharing information on how to link aadhar card with PF UAN number.But there is no delete option to delete wrongly entered kyc details in uan member portal.