Permanent Account Number or PAN card is a unique 10 digits number which is assigned to all the tax paying citizens of India. It is issued by the Income Tax Department. This card links all the tax attracting transactions under a single source, so that it becomes convenient to keep track for the government. PAN card is important for filing income Tax returns and all citizens who pay tax, even foreigners who reside in India are required to have a PAN card. Apart from its main use, a PAN card is also valid to be presented as a proof of identity and a proof of age for facilities like booking movie tickets, investing in stock market and applying for a passport.

Aadhar card is a very important document serving purpose of a proof of identity, a proof of address, and a proof of date of birth, it consists of a Unique Identification Number known as Aadhar number that holds all the personal information and contact details along with demographic and biometric data of a citizen. It is an innovative initiative by government of India and the intent is to have a single identification document for each citizen of India regardless of their age, religion and gender. It has become necessary to have an Aadhar card in order to avail services from government schemes and services for the purposes of registration and verification, hence making it one of the most meaningful document.

Procedure to Link Aadhaar Card with PAN Card:

The process of linking PAN card to Aadhar card is not at all complex, just follow these easy steps:

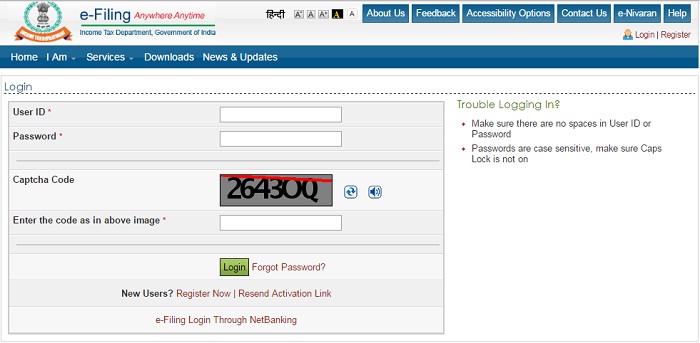

- To link a PAN card with an Aadhar card, tax paying citizens are required to register on the E-filling portal of Income Tax Department. After doing so, follow these steps given below:

- Visit the official website of Income Tax Department and login by entering your User ID, Password and Captcha Code as shown there to the E-filling portal.

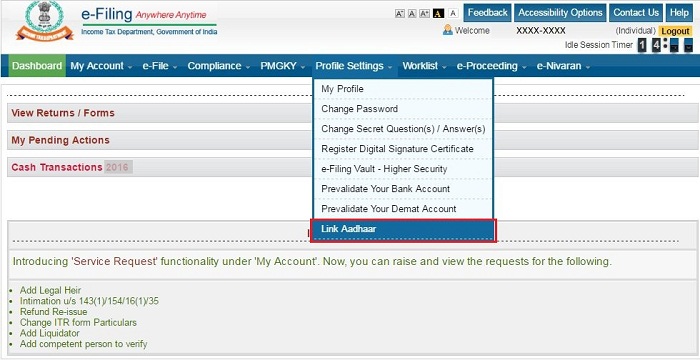

- After logging in, a window will pop up, moving you on the way to link your PAN card to Aadhar card, If Pop Does not appears then you have to click on “Profile Settings” under Main Menu.

- Now you have to click on “Link Aadhaar” from the drop down list.

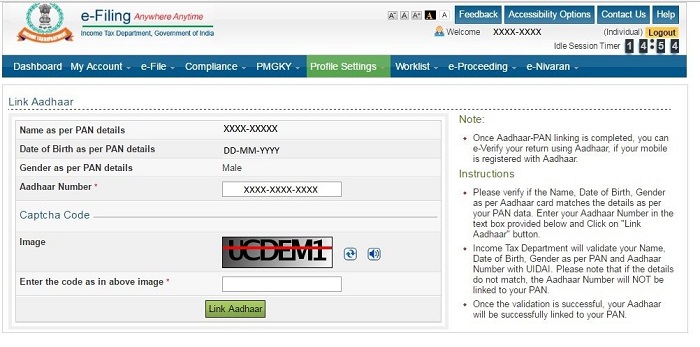

- All the personal information like Name, Date of Birth and Gender as per PAN details will be already mentioned according to the information that were provided during the time of registration on the E-filing portal.

- Check if the information on your screen matches with information demonstrated on your Aadhar card.

- After verifying all the details, Enter your 12 digits Unique Identification Number or Aadhaar Number in the Box.

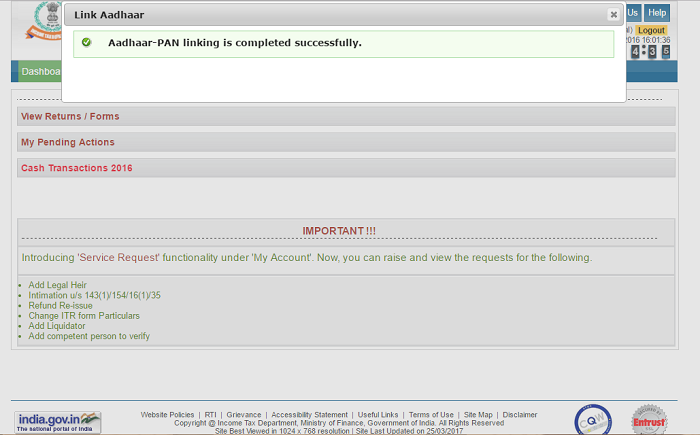

- Click on the “Link Aadhaar” button.

- You would see a pop up message letting you know that your PAN card has been successfully linked to your Aadhar card as “Aadhaar-PAN linking is completed successfully.”

Reasons why to Link Aadhar card and PAN Card?

The Aadhar card and PAN card are both unique identification documents that serve as a proof of identity that are required for the purposes of registration and verification in order to avail certain services announced by government.

It has been made clear by government for all the citizens to link their PAN cards with their Aadhar cards. The reasons to do this are given below:

To Prevent Tax Evasion:

When the PAN card is linked with Aadhar card, it is practicable for government to be able to keep tabs on cardholder’s transactions, as the verification of their identity will be done by Aadhar card. It is considerably understood that every taxable transaction and activity is recorded by the government.The government will have an elaborated record of all the financial transactions that are taxable, refraining tax evasion effectively.

Counterfeit PAN Cards:

The other reason behind the government’s decision to link PAN card with Aadhar card is to restrain the ill-practice of issuing counterfeit PAN cards on a single name that leads to fraud the government and tax evasion. When a person applies for more than one PAN card, they can use any of those cards for particular transactions and pay applicable taxes. On the other hand, the PAN card is also useful for accounts or transactions that the individual doesn’t wish to disclose to the Income Tax Department, hence avoiding to pay taxes for them. After linking PAN card and Aadhar card, the government is able to link the identity of a person with their Aadhar card, and gain details of all financial transactions done linked with the PAN card. In case more than one PAN card is registered under the same name, it would become simplified for the government to identify the fraud and take the appropriate action accordingly.

Easy Filling of Income Tax Return:

It becomes an effortless and quick process to file E-returns or online Income Tax Returns for the citizens who have linked their PAN cards to their Aadhar cards. After linking PAN card and Aadhar card, citizens would not need to submit their Income Tax Acknowledgement to the Income Tax department, hence making it a lot convenient for taxpayers by saving them a lot of trouble.